Professional, Transparent, Value-driven Credit Repair Outsourcing Service.

The First and Original Credit Repair Outsourcing Service – Since 2009.

One stop source for personal credit services, including defaulted debts and student loan assistance.

Time-Saving Credit Repair Programs

The Dispute Center’s credit repair outsourcing allows you more time to expand and grow your credit repair business.

Advanced Credit Repair Strategies

We follow a comprehensive, time-proven 3-step strategy and do the heavy lifting for you.

Personalized Credit Repair Training

The Dispute Center offers high-quality, one-on-one credit repair business training to meet your experience level and goals.

“Our mission is to provide you with full transparency, timely support, and results driven actions. By helping you become knowledgeable in credit, we strengthen your confidence , which builds trust with your clients, and in turn increases your sales and client retention.”

Flexible Credit Repair Outsourcing Programs

We offer 4 program levels, starting at just $25 per month. They include company branded notices, account updates, and recommendations. You can match levels to our customers needs or offer one specific package. The Dispute Center offers you experience, options, and value.

Add-On Services and Referral Program

Provide more value and grow your credit repair business by offering your clients profitable add-on services. Don’t want to start a credit repair business but have clients that need credit repair help, ask about out Referral Program. We have several options to meet your needs.

Call us today at (616) 541-2322 to find out how you can grow your business with The Dispute Center’s professional credit repair outsourcing.

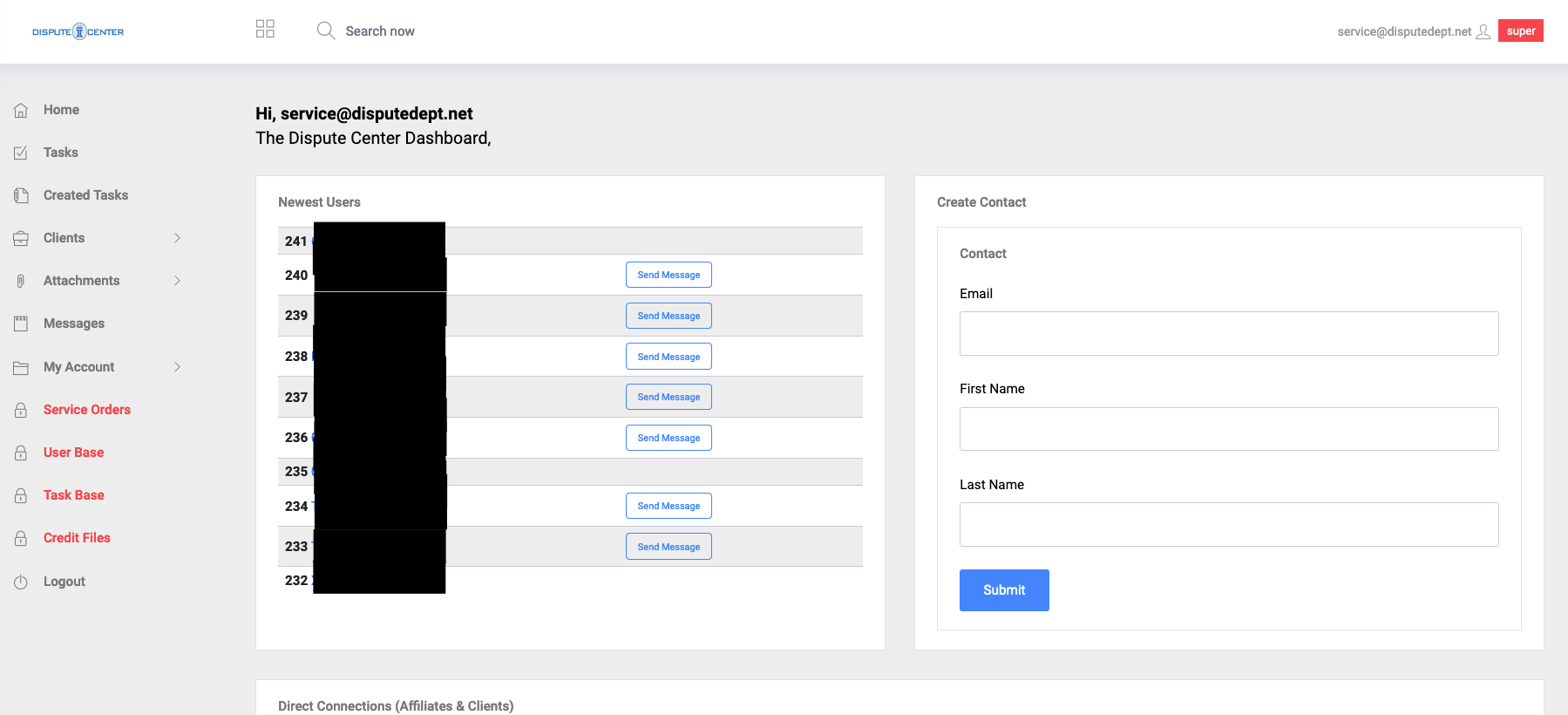

Credit Repair Software & White Label Branding

Our internal credit repair outsourcing package includes a company branded 24/7 secure client/affiliate portal to track client progress, upload documents, secure messaging, assign tasks, review credit reports, and more. You can manage your clients, leads, and affiliates.

7 Tips For Running a Successful Credit Repair Business

Running a successful credit repair business is challenging at best with all the regulations and eyes upon your business. Following these seven tips can help you succeed as a trusted authority in credit repair. Maintain ConfidentialityTrust is paramount to an...

Grow Your Credit Repair Business with 1 Simple Action.

In this article you will learn how doing this one simple action can help you grow your credit repair business exponentially.

Our Time-tested, Proven 3-Pronged Credit Strategy

Our credit strategy has helped thousands of clients reach their credit goals and obtain the financing and credit they were seeking.

Teach Your Clients About the 8 Types of Companies That Look at Credit Reports

Even if you are not applying for a loan certain companies will look at your credit report before approving you for services.

4485 Plainfield Ave NE, STE 101

Grand Rapids, MI 49525

(616) 541-2322

M-F 9 am to 5 pm ET.

Photo Copyright: Photographee.eu / Fotolia & BillionPhotos.com / Fotolia